15 Ways to Save Money Living on a Tight Budget

Share

Times are tough, money is scarce, and living on a tight budget can make any kind of savings seem completely unachievable. But having at least a little stashed away for emergency use is SO important. The key thing to know about savings is that any amount is better than none at all.

Even if you feel that putting $20 away per week is going to get you nowhere, then consider this:

$20 into savings every week is $1040 per year. Do that as a *minimum* for ten years, and you’ll have a nice little pot of money for any unexpected emergencies, or simply to put towards your living costs in retirement. If you can put in $40 per week, that’s even better. But the key here is simply to make a start - no matter how small the amount.

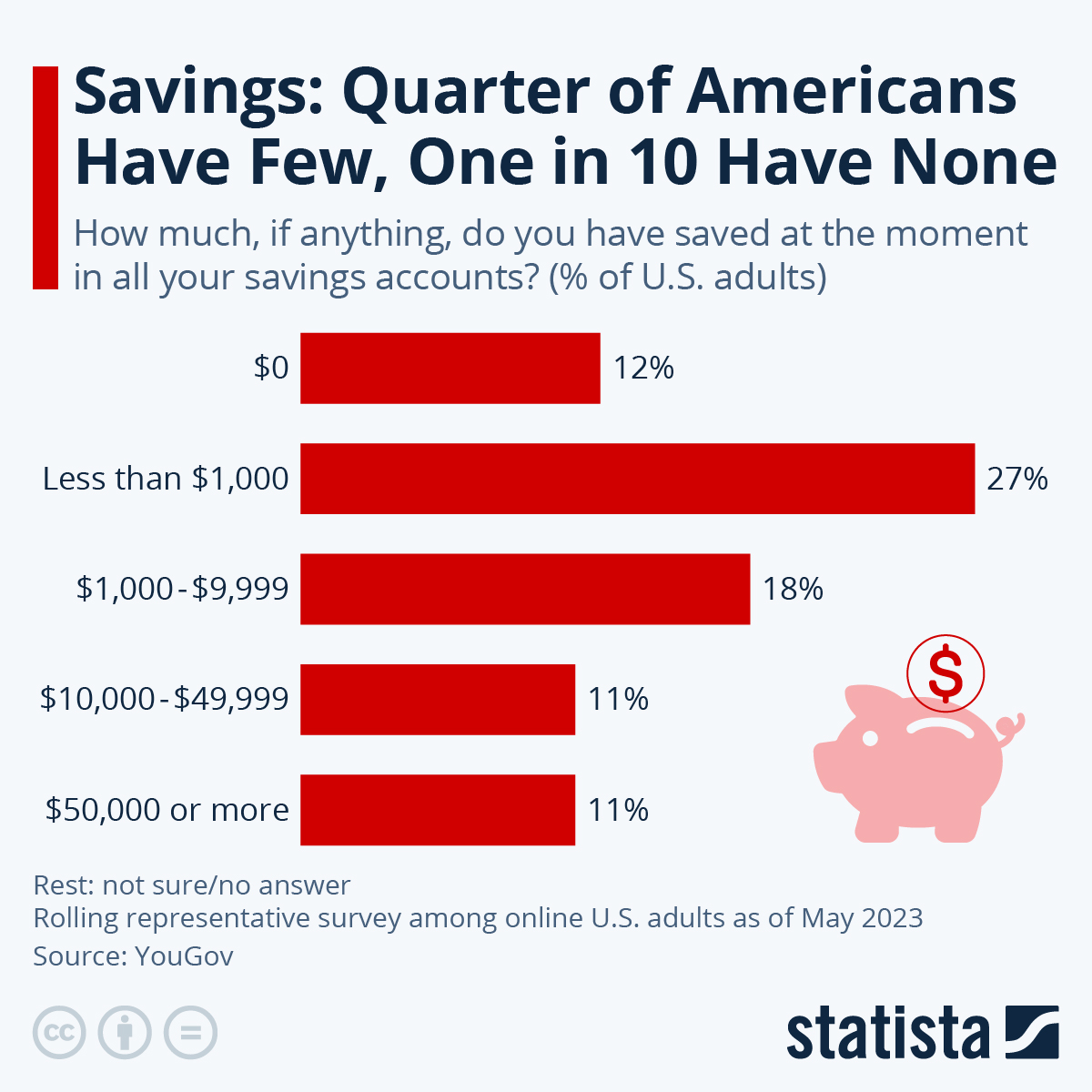

If it’s hard for you to find ways to save money on a tight budget, you’re not alone. As the survey below demonstrates, a massive 45% of Americans have absolutely no savings whatsoever. Another 24% have between $0 and $1000. That’s a start, but when it comes to money, the more the merrier.

If you’re living on a tight budget and still trying to find ways to save money, this article is for you. Here are our 15 Tips for saving money on a tight budget. Check them out!

1. Review Your Outgoings

To kick things off, you’re going to need to sit down and map out all your incomings and outgoings. This is the time to be totally across your financial situation. How much do you earn? How much do you pay in taxes? What bill payments come out, and when? The aim here is to get a complete overview of what’s going on in your financial life.

2. Analyze Everything

Now’s the time to get ruthless. Do you NEED Netflix? Can you go a year without buying new clothes? Can you do your own hair and nails for a change? Are you getting the best deal possible from your utility providers? Work through your outgoings one by one, and make some serious decisions about how vital each thing is in your life.

3. Get Rid of “Nice-to-Haves”

Paring back your budget to the basics is one of the most important things you can do to improve your savings situation. That means getting radical about the things you need versus the things that are nice to have. This goes further than luxuries like Netflix and hair stylist appointments. This is about saying no to buying Christmas presents for extended family. Or choosing to walk an extra 15 minutes instead of spending money on gas for your car. It’s amazing what freedoms a more minimalist lifestyle can open up - especially when it allows you to save more money for the future.

4. Scale Back on Bills

Are you paying more than you should be for bills like electricity, water, internet, and gas? By taking the time to shop around, or by looking for scaled-back plans with your current providers, you could save hundreds of dollars a year on those pesky bills that turn up like clockwork in your mailbox.

5. Set Up Automatic Payments

One you’ve decided on a weekly, fortnightly, or monthly savings amount that you are confident you can put aside, set it in stone by organizing an automatic payment from your bank account into a dedicated savings account. Most importantly this payment should be set up to come out as soon as possible after your paycheck arrives in your account. The aim here is to minimize the time you have access to that money. If it comes and goes before you have a chance to see it, you’ll get used to living within your means. Meanwhile all those delicious savings are stacking up in your out of sight, out of mind savings account. Win!

6. Steer Clear of Social Media

It doesn’t sound like savings-related advice, but dialling back the time you spend on social media is a useful way to save money while living on a tight budget. Social media, television, malls, and even just casual strolls around the city are all hotbeds of incessant advertising. Beautiful images on Instagram and targeted ads on Facebook and YouTube are constantly telling us how much we’re missing out by not having the newest objects of desire. Surrounding ourselves by this persistent commercialism does absolutely no favors to our bank balance. So if you’re serious about savings, consider a step back from the sites that are constantly trying to sell you something.

7. Pay Down High-Interest Debts

Being in debt is HARD, but paying off loans and getting back in the black *is* possible. The key to clearing debt to make way for savings is to prioritize paying off the loans with the highest interest rates first. High interest loans can be the death of your savings goals. So get rid of them as a matter of priority!

8. Hide Your Credit Cards

On a similar note, now’s the time to play Hide and DON’T Seek with your credit cards. They are your false friends - pretending to offer you a lifeline when you’re living on a tight budget, but then demanding more and more back at the end of every month.

9. Save Yourself From Fees

How much do you lose to banks and other services providers every year thanks to sneaky fees you either didn’t know about or swept under the carpet? First things first: check and see! And after that? Do something about them!

10. Set Up a Side Hustle

Once you’ve given yourself a little breathing room by working on your debts and scaling back your expenses, consider whether a small increase in income might help you reach your savings goals. We’re not suggesting you work day and night to scrape together $1k a year. But if you have a little business idea you’ve been wanting to get off the ground, now is the time to give it some life! Set up an Etsy shop, sell your art or plants at a weekly market, or simply pick up a few babysitting gigs here and there. The extra money will really start to add up!

11. Keep Track of Every Dollar

Living on a tight budget makes spending tough anyway, but that shouldn’t give you free reign to use every dollar of your paycheck, week after week. Keeping track of what you spend will help you perfect the art of trimming the fat. Monitoring your expenses in a Budget Planner is a great place to start.

12. Be a Savvy Shopper

If you truly want to save money while living on a tight budget then transforming yourself into a savvy shopper should be a matter of priority. We’re talking coupons, sales, freebies and bulk-buys - just make sure you also learn the art of staying *away* from the shops as much as you learn the art of interacting with them!

13. Make Savings Hard to Access

Make sure your savings account is out of sight, out of mind. Don’t include it on your bank card, and consider opening it with a different bank, simply to keep your access to a minimum.

14. Set Goals

Get a pen and paper, or your trusty tablet, and write down your short, mid and long-term financial goals. It’s far too easy to end up wandering aimlessly through your financial life. Goals and plans can genuinely mean the difference between having savings in your retirement and not - or being able to afford that unexpected bill when unforeseen circumstances arise.

15. Living on a Tight Budget? Keep a Budget Planner

If you’re serious about getting organized and finding ways to save money on a tight budget, consider downloading a digital budget planner. Planners can do wonders for your financial situation and help you to meet your savings goals, even when you’re living on a tight budget!

Happy saving everyone!