50/30/20 Budget Rule: A better way to budget your money

Share

Do you want to have more money to do what you want? More money to fix your problems. To stress less about money issues?

Yes?

Ok, this is for you then.

I know budgeting is boring and most people don't do it but, if you set up a budget now, you'll live a happier life and be glad you did.

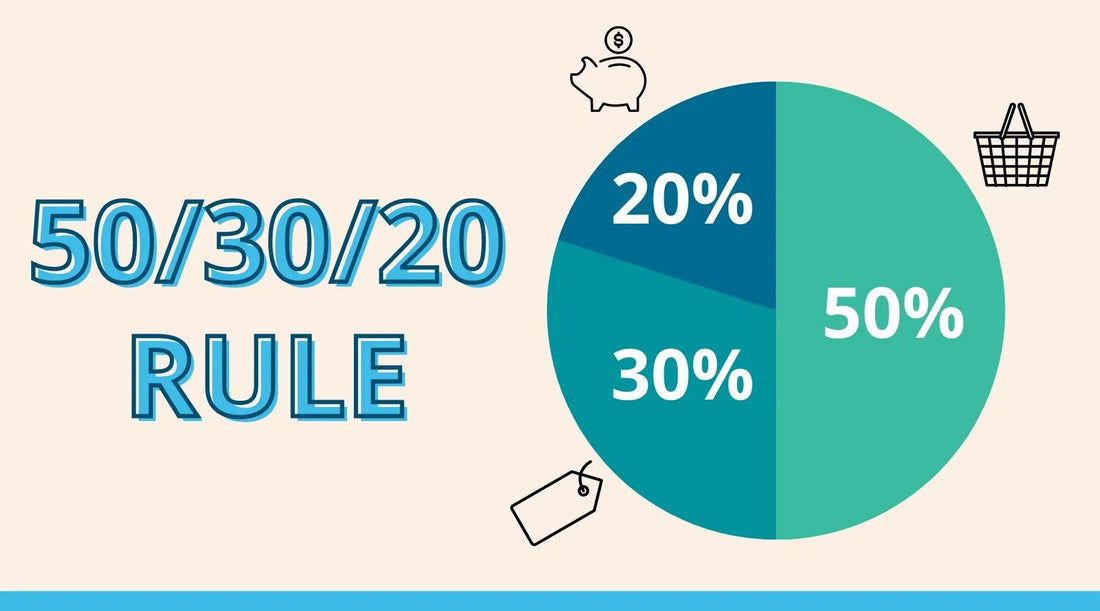

Today, we are going to be looking at a specific type of budget that is very simple and popular. It's called the 50/30/20 rule or budget.

What is the 50/30/20 rule?

This is one of the easier budgeting methods to use, all you have to do is break your money up into three categories.

- Needs

- Wants

- Savings

Yes, that's all you're focusing on, needs, wants, and savings. This is where the 50/30/20 part comes in as well because 50% goes towards needs, 30% goes towards wants, and 20% towards saving.

An example of a 50/30/20 budget

Let's create a very simple example to show what it looks like. We'll use an income of $3,500 net or take home pay after tax.

50% for needs = $1,750

30% for wants = $1,050

20% for savings = $700

Now you know how to allocate your money for the upcoming month.

Where did the 50/30/20 rule come from?

The 50/30/20 rule was originally put together by U.S. Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi.

In their 2005 book, "All Your Worth: The Ultimate Lifetime Money Plan," they introduced this method as a way to easily budget your finances.

They stated that you don't need to complicate your budget to get your finances in order, all you need to do is correctly distribute your money across needs, wants, and savings.

How to set up your 50/30/20 budget

Let's take a little bit of a deeper look at how to set up the 50/30/20 budget and what each category includes.

Spend 50% of your money on needs

The most important part of your budget is figuring out the expenses you need. These expenses are the most important and must be taken into account first.

Examples of need expenses

- Rent or mortgage

- Insurances

- Utilities

- Food

- Transportation

- Medical and health

- Basic clothing

- Minimum loan payments

It's important, to be honest with what goes in the needs category. You don't need a TV package or streaming service, those aren't basic necessities.

You need to pay for housing though, and food and basic utilities. These are your true monthly need expenses.

Spend 30% of your money on wants

Next, we have your wants category. 20% of your monthly income can be allocated to this category.

examples of want expenses

- TV and streaming services

- Eating out

- Entertainment

- Travel and vacations

- Gym or other memberships

- Electronics and gadgets

- Fun vehicles

These are all of the expenses that you can live without. Make sure you're properly allocating these expenses and not putting them in the need category.

Spend 20% of your money on savings

The final category is your savings.

Saving is a pivotal part of any budget and thats not exception to the 50/30/20 rule. Not only will you build up your savings, there can also be tax credit or benefits depending on what you're doing. Definitely talk with a CPA to get more information on any tax related things.

How you can save money

- Put it in a savings account

- Create an emergency fund

- Saving for retirement (additional to your 401k)

- Invest (comes with risk)

However you do it, taking 20% of your take home pay and putting it into some sort of savings account each month will build a long term financial foundation for you.

Most people today have little to no money saved, making this small contribution will help you avoid the problems those people will face later in life.

Savings AND debt repayment

While it's not often mentioned, this is actually a savings and debt repayment category.

And while you may say, "I thought debt payments were under the needs category?"

Yes, the minimum is under the needs but it's always good to make additional payments which would be placed under this category.

A good rule of thumb is to focus on paying off debt before saving and investing. Typically loans or credit cards have high interest rates so by paying off them earlier, you'll have more excess money when the debt is gone.

Another benefit to paying down debt more quickly is it will increase your credit score.

Just a rule of thumb, make it your own

This is just a rule of thumb, no budget is set in stone that can only be followed as it is laid out.

The goal is to make better financial decisions and habits. If the 50 30 20 rule doesn't fit your life, you can adjust the categories.

A good rule of thumb though, if you have to make one of the categories smaller, the wants category should be the first one to shrink.

When you first start, your finances may be a little messy and one of your financial goals might be to pay off some unwanted debt. If this is the case, you may want to reduce the wants category to only 15% and add the extra 5% to your savings and debt, giving you extra money for debt payments.

Focus on the long term

Whenever you initially create a budget and you haven't had a budget before, your finances might look pretty bad.

The good news is, if you follow the budget, such as the 50/30/20 rule budget, in time, your finances will correct themselves.

There are lots of things you can do to improve your financial health.

- Learn to live without some "wants"

- Pay off any outstanding balance on your credit cards

- Increase your monthly income with a side business

- Increase retirement contributions

- Reduce wasteful spending

- Set aside more money for your emergency savings

- Shop around for better rates and prices (insurance, utilities, etc)

Small steps add up over time

It's important to remember that the small things will add up over time. If you consistently do things to improve your personal finance situation, you'll see exponential results over time.

You might here people make comments like "not buying coffee every day isn't going to make you rich." In a way, they are correct.

But when there are 5 or 10 things you do that are wasteful or hurting your personal finances, then it will add up. Maybe those small things add up to a few hundred dollars per month.

That extra few hundred dollars could go towards debt payments or your retirement savings.

Even if you cut things out, it doesn't have to be forever. It could be a temporary change that you do until you get your finances in a stronger position.

Combining the 50/30/20 rule with a budget tool

We offer several budget planners that can be used with the 50/30/20 rule to help you budget a little easier.

You can't just build a budget in your head, you have to have a tool to do it. We believe that you should avoid budget apps that do everything for you because you "set it and forget it" and you definitely don't want to forget your budget.

With our tools and templates, you just need to fill it out once and then add transactions as they happen.

It's a great way to manage your personal finances and use it for your 50/30/20 rule budget. You'll be able to keep your finances organized which is one of the important steps to any budget.

What happens if I can't afford it?

Keep in mind, many people fail budgets when times get tough. Sometimes, unexpected expenses or bills come up that need to be taken care of.

It's better to simply adjust your budget for the short term than to give it up completely.

If you need to, try and cut spending from your wants expenses instead of touching the savings.

Even if you have to make an adjustment to the savings, it's better to save only 10% than to ditch the until budget and save nothing.

50/30/20 rule final thoughts

If you're looking for a new budget method, the 50/30/20 rule is a great one to start with.

It keeps things very simple yet provides excellent direction for your personal finances. No matter what your financial goals are, this rule will help you achieve it.

By breaking down your monthly income into the three categories and

The bottom line, the sooner you start using the 50/30/20 rule, the faster you'll improve your money situation.