What to do with Your Stimulus Check

Share

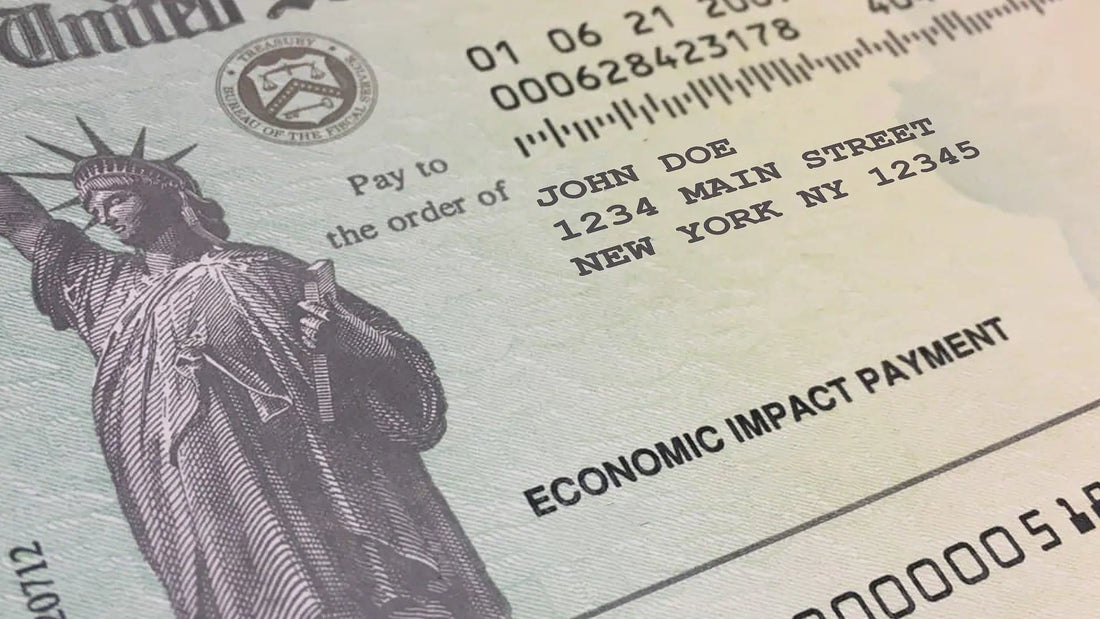

With the latest round of stimulus aid being passed, you may have some money coming your way, $1,400 or more if you have a family.

If you’re excited for the money you’re getting, you should be, it can help many people and families. If you’re thinking about the video games, vacation or a fun night out with that money, you might need to sit down and rethink things though.

We’ve put together some ways to put that money to good use. As much fun as it is to buy new toys or have fun with the money, we have no idea what the future of the economy is for the next few years, it could get a lot worse.

So time to break out your budget and figure out where that $1,400 is going.

Why you need to budget

The economy is not good and it could get a lot worse. While the government is sending everyone money right now, they can’t do this forever, eventually it will have devastating effects.

With the state of the economy, no one is going to know how things will be in a year or two. If you listen to many economists and great investors, they have modest projections for the next 2 years at best, some even calling for a drastic recession like 2008.

As many of you may or may not remember, many people lost jobs in 2008 and were wrecked financially. You do not want that to happen to you. You want to be ahead of everything.

Sticking to a budget is a great way to ensure you aren’t put out on the streets if things flip upside down, even if you lose your job.

Below are some of the things that should take priority when you’re budgeting your $1,400 stimulus check.

Pay off credit cards and loans

This is probably the number one thing you should do. Especially if your debt is in high interest credit cards. Credit cards typically have interest rates of over 20% which can be devastating to your personal finances if you don’t stay on top of it.

A good practice is to order your debts by the highest interest rate and pay that one off first. Make minimum payments on all other debts but put the bulk of your payment towards the high interest account. As you pay off each account, you’ll have more money to put towards the next highest interest rate.

After you get out of debt, you should continue to use your budget to avoid using debt and credit cards in the future. If you look at all the money you paid in interest, please do this now, you’ll be sick.

In the future, you’ll be able to use that interest payment money for your retirement, emergency fund, or even just some fun money.

Save for retirement

You should have some sort of financial account setup for retirement because if you want to retire someday and not work until you die, you’re going to need money, and lots of it. Savings accounts don’t count here either.

We won’t go into financial advice on what to invest in but there are lots of methods to invest in your retirement on your own. You can do research on what methods you want.

A few years ago, a story about a janitor who amassed a fortune of around $8 million was all over the news. He took the simple strategy of continually adding to his stock portfolio and it grew and grew.

People make the stock market sound scary but when used correctly, it is an amazing tool to grow wealth. Real estate is hard for average people to invest in and manage, and standard bank accounts have little to no return so you actually lose money to inflation, but anyone can open a brokerage account and buy stocks that will grow over time, and possibly earn income via dividends.

There are also assets like ETF’s and mutual funds you can buy instead of individual stocks. If you’re interested in learning more about these, we definitely recommend doing additional research.

The age old saying is, the best day to plant a tree was 20 years ago, the next best is now. Same thing applies for retirement accounts. Start today so you don’t have to worry about little to no social security one day.

Put it towards your emergency fund

Do you have a minimum 6 month emergency fund? Most American’s don't, which is scary. If you lose your job, how long can you survive with no income?

If that happens and you lose your job, will you be ok? Or are you living paycheck to paycheck with no emergency fund. 6 months is enough time to get unemployment if possible and give you time to find a new job or income source.

Figure out how you can build a 6 month emergency fund, quickly. The great thing is, once you have that magic 6 month number, you can lower your contribution if necessary. Keep putting in to increase the cushion but allocate some of that money to something like your retirement account.

If you lose your job, the last thing you want to worry about and stress over is how you’re going to pay next month's bills.

Start a side business

This is a great time to start a side business and a good use for the stimulus check. If some of the other areas we talked about are taken care of and you have a business you want to start, look into that.

Depending on what you want, you can create a nice side income. If your goal is to quit your current 9-5, be careful with doing that too soon. If you can work a 9-5 while building a business on the side, it might be the smarter route to go.

A side business can generate a significant income for you. Whether it’s an extra $1,000, $5,000, or maybe even $10,000 a month. The possibilities are endless if you find the right business and put in the work.

Make sure you thoroughly research the business and make the best educated decision to see if it is worth starting.

Buy necessities that you need

Be careful with this part, only buy the things you need. You don’t need the new Playstation 5 or iPhone. Those are nice to have but not necessary.

If you need to make a car or home repair, this might be a good time. You need to determine how important the purchase is and if it can wait. If it can wait, you should put the stimulus money to one of the above categories.

While none of this is fun and exciting compared to buying a new car or going on a fun vacation, they will ensure you can do those kinds of things for the rest of your life and not just when someone gives you money.

What to do with Your Stimulus Check Final Thoughts

So take the steps today to figure out how to budget your stimulus check and make sure you get the most out of it. You may have had fun with the last 2 stimulus checks but now it’s time to get serious.

If you would like a budget template, we offer a great digital budget planner (see below for a discount). It is intended to be used with annotation apps on a tablet with a stylus but you can even print it if you’d like. You’ll be an expert in all your personal finances and on a path to wealth.

Whether you use our budget planner or create your own, it’s important that you start your budget now. Unfortunately, many people aren’t taught about proper budgets or managing their money but now you can take charge on your own.

Good luck and happy budgeting!

For a limited time, you can use the discount code STIM to save 30% off your budget planner purchase. Expires 3/31/2021 at 11:59pm CST.